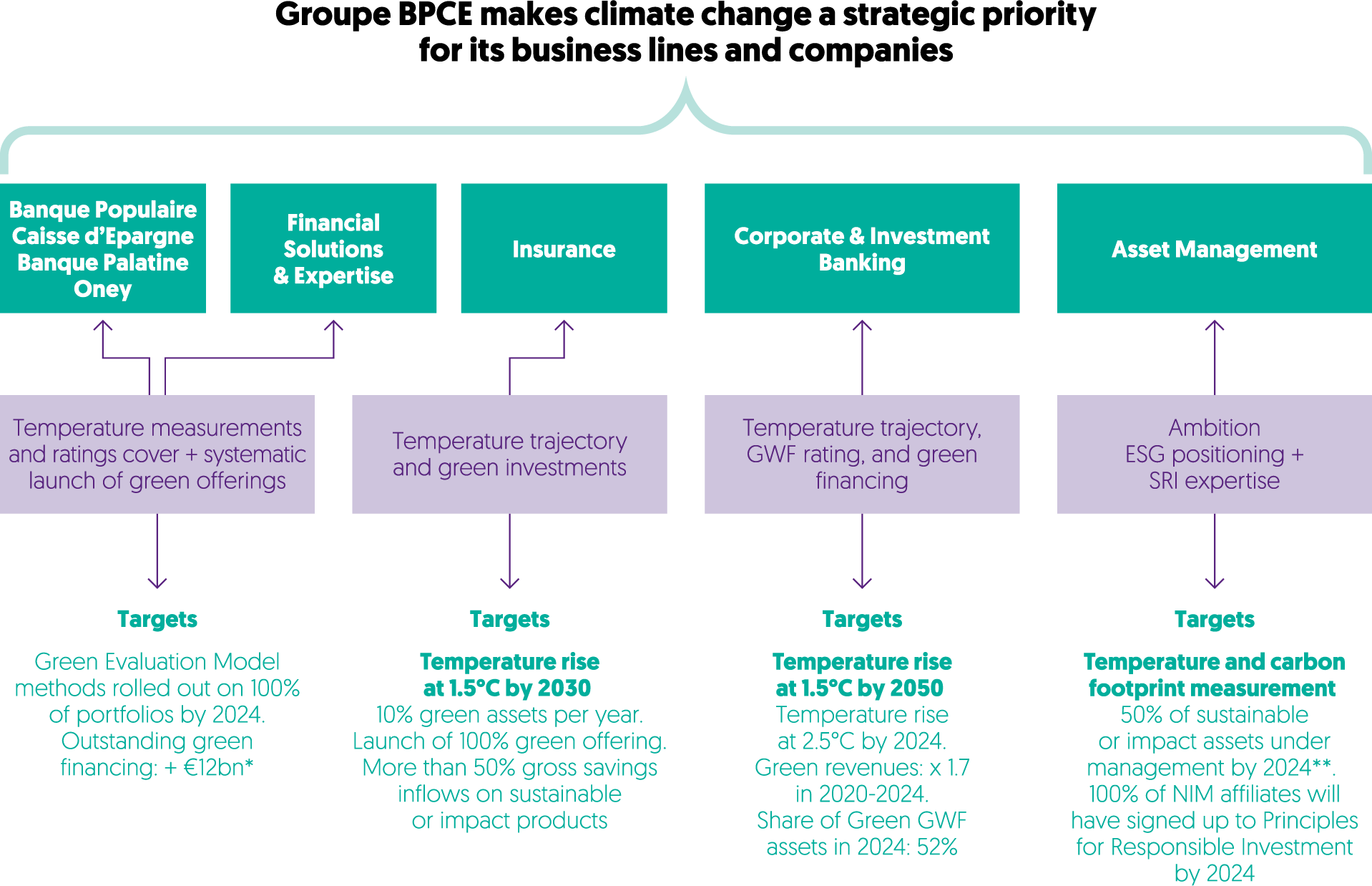

This diagram shows the BPCE making climate change a strategic priority for its business and companies.

Banque Populaire, Caisse d’epargne, Banque Palatine and Oney

Temperature measurements and ratings cover plus systematic launch of green offerings

Targets: Green Evaluation Model methods rolled out on 100% of portfolios by 2024. Outstanding green financing: + €12bn*

Financial Solutions & Expertise

Temperature measurements and ratings cover + systematic launch of green offerings

Targets: Green Evaluation Model methods rolled out on 100% of portfolios by 2024. Outstanding green financing: + €12bn*

Insurance

Temperature trajectory and green investments

Targets: Temperature rise at 1.5°C by 2030

10% green assets per year. Launch of 100% green offering. More than 50% gross savings inflows on sustainable or impact products

Corporate and Investment Banking

Temperature trajectory, GWF rating, and green financing

Targets: Temperature rise at 1.5°C by 2050

Temperature rise at 2.5°C by 2024. Green revenues: x 1.7 in 2020-2024. Share of Green GWF assets in 2024: 52%

Asset Management

Ambition ESG positioning plus SRI expertise

Targets: Temperature and carbon footprint measurement

50% of sustainable or impact assets under management by 2024**.

100% of NIM affiliates will have signed up to Principles for Responsible Investment by 2024

* Financing for energy renovation, renewable energy and green mobility from the Banque Populaire and the Caisse d’Epargne.

** Eligible under Article 8 or 9 of the Sustainable Finance Disclosure Regulation.