An initial milestone for the alignment of financing portfolios with a 2.5°C trajectory as early as 2024

Alignment of the Natixis CIB portfolio

From climate impact to the trajectory of portfolio alignment for the Corporate & Investment Banking division using the GWF

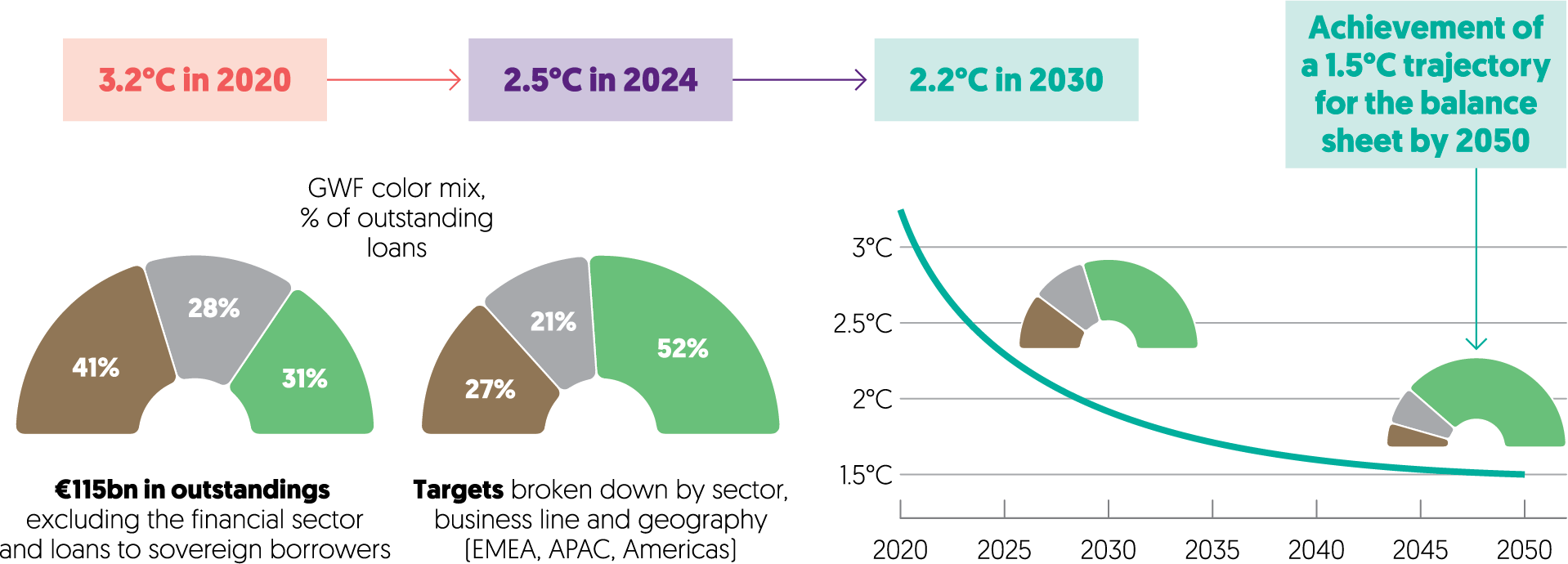

This graph shows alignment of the Natixis CIB portfolio, from climate impact to the trajectory of portfolio alignment for the Corporate & Investment Banking division using GWF.

In 2020: 3.2°C

In 2024: 2.5°C

In 2030: 2.2° C

Achievement of a 1.5° C trajectory for the balance sheet by 2050

GWF color mix, % of outstanding loans:

Brown: 41%

Neutral: 28%

Green: 31%

€115bn in outstandings: excluding financial sector and loans to sovereign borrowers.

Brown: 27%

Neutral: 21%

Green: 52%

Targets: broken down by sector, business line and geography (EMEA, APAC, Americas)

The Group uses these ratings and measurements of global warming trajectories to:

- Engage a strategic dialogue with customers and structure the sustainable financial products resulting from this dialogue,

- Manage the portfolios in an active manner,

- Implement a strategic business planning system in line with its commitments, including - as far as the customer ranking is concerned - the definition of priorities and identification of sustainable financing opportunities,

- Steer the portfolios into alignment with a 1.5°C trajectory.

Groupe BPCE is now in a position to measure the carbon intensity of its portfolios potentially having the most significant climate impact and to manage their alignment with a Net Zero trajectory. The Green Evaluation Models approach, which broadens the scope of these measures to the portfolios of the retail banks, will be rolled out for all its financing portfolios by 2024.

Co-Head of Natixis Corporate & Investment Banking

“The fight against climate change is central to our business model, geared in favor of value creation. One of the major challenges of the environmental transition is to articulate a long-term strategic vision with execution in the short term. The Green Weighting Factor successfully combines the two by assessing the climate impact and climate transition risk of each financing operation, and thereby enabling us to adopt clear and precise commitments over the long term.”