3.2 - Integration of environmental criteria for insurance and asset management activities

Groupe BPCE, which recognizes that risks related to climate change may have a non-negligible impact on investments made in pursuit of its life insurance business, aims to apply appropriate management procedures in their respect. The management of sustainability risks and negative impacts in the Insurance division’s portfolio is based on a sectoral, normative and best-in-class exclusion approach, representing the foundation of its ESG commitment (tobacco, coal, controversial weapons, oil sands, and companies with negative sustainability ratings). Beyond risk management, Groupe BPCE is committed to making a positive contribution to the Sustainable Development Goals in its insurance activities. This commitment involves a policy of selective ESG integration that allows the Group to improve the ESG profile of investments under management mandate and in dedicated funds, based on the approach to ESG assessment developed by Mirova (a Natixis Investment Managers affiliate). This policy - which mirrors the exclusion of ‘negatives’ - consists of increasing the proportion of sustainable assets in the portfolio, comprised of ‘positive’ issuers (making a positive contribution to achieving the Sustainable Development Goals) and ‘committed’ issuers (making a very positive contribution to achieving the Sustainable Development Goals).

In non-life insurance, a portion of the risks (including climate risks) is transferred to global reinsurers through various reinsurance treaties in order to reduce the balance sheet impact of climate-related claims.

Lastly, in the asset management segment, Natixis Investment Managers has identified climate-related risks as a major challenge and is seeking to improve its understanding of them in order to support sectors and companies working to promote the transition and to invest in positive impact projects.

The majority of affiliated asset managers have integrated ESG criteria at various levels in their investment and engagement processes. This practice is accompanied by a large number of related actions: provision of training courses, development of methodologies, work on climate data, and measurement of the carbon footprint of our portfolios.

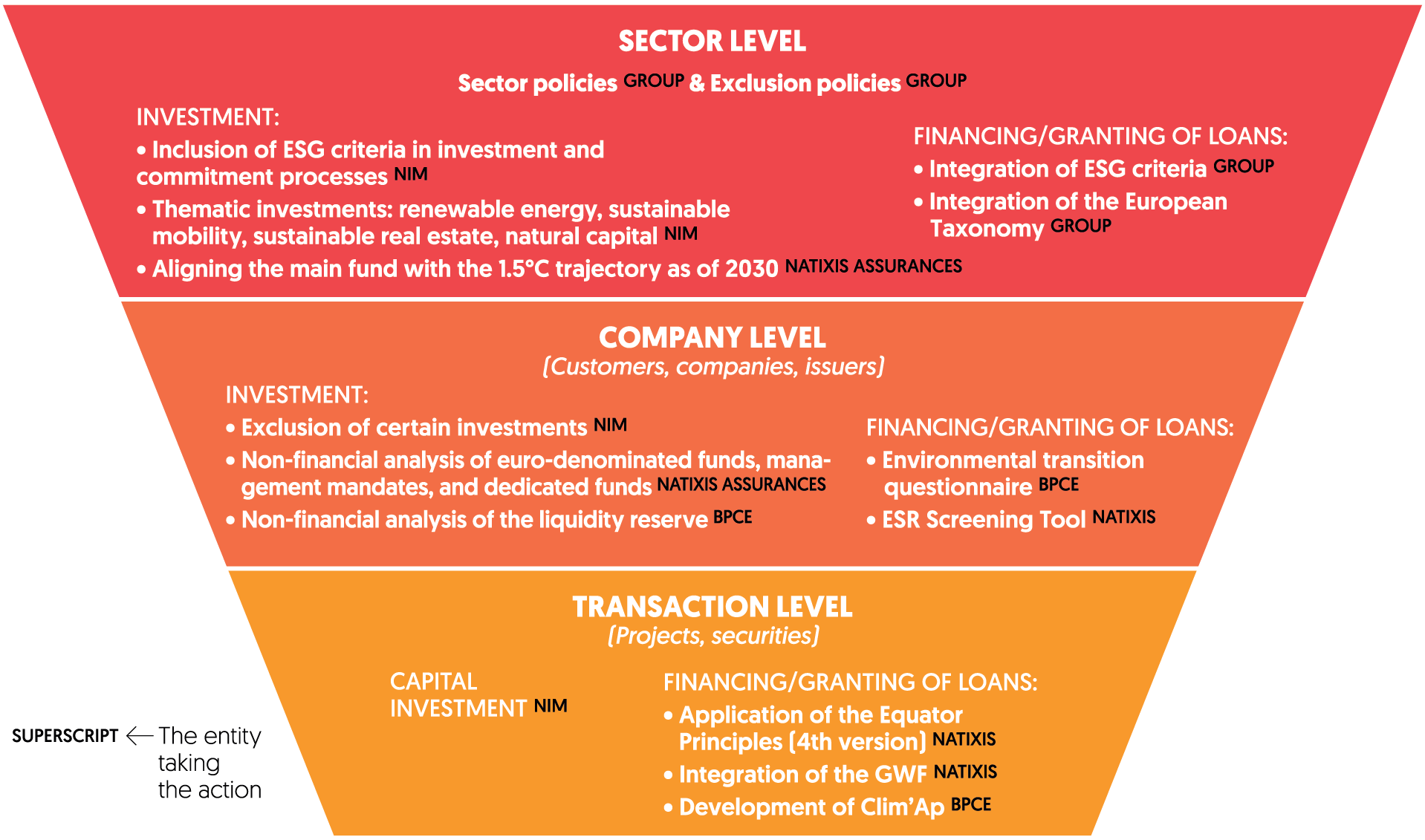

From sectoral perspective to transaction

SECTOR LEVEL

Sector policies GROUP & Exclusion policies GROUP

INVESTMENT :

- Inclusion of ESG criteria in investment and commitment processes NIM

- Thematic investments: renewable energy, sustainable mobility, sustainable real estate, natural capital NIM

- Aligning the main fund with the 1.5°C trajectory as of 2030 NATIXIS ASSURANCES

FINANCING/GRANTING OF LOANS:

- Integration of ESG criteria GROUP

- Integration of the European Taxonomy GROUP

COMPANY LEVEL

(Customers, companies, issuers)

INVESTMENT:

- Exclusion of certain investments NIM

- Non-financial analysis of euro-denominated funds, management mandates, and dedicated funds NATIXIS ASSURANCES

- Non-financial analysis of the liquidity reserve BPCE

FINANCING/GRANTING OF LOANS:

- Environmental transition questionnaire BPCE

- ESR Screening Tool NATIXIS

TRANSACTION LEVEL

(Projects, securities)

CAPITAL INVESTMENT NIM

FINANCING/GRANTING OF LOANS:

- Application of the Equator Principles (4th version) NATIXIS

- Integration of the GWF NATIXIS

- Development of Clim’Ap BPCE

SUPERSCRIPT

The entity taking the action